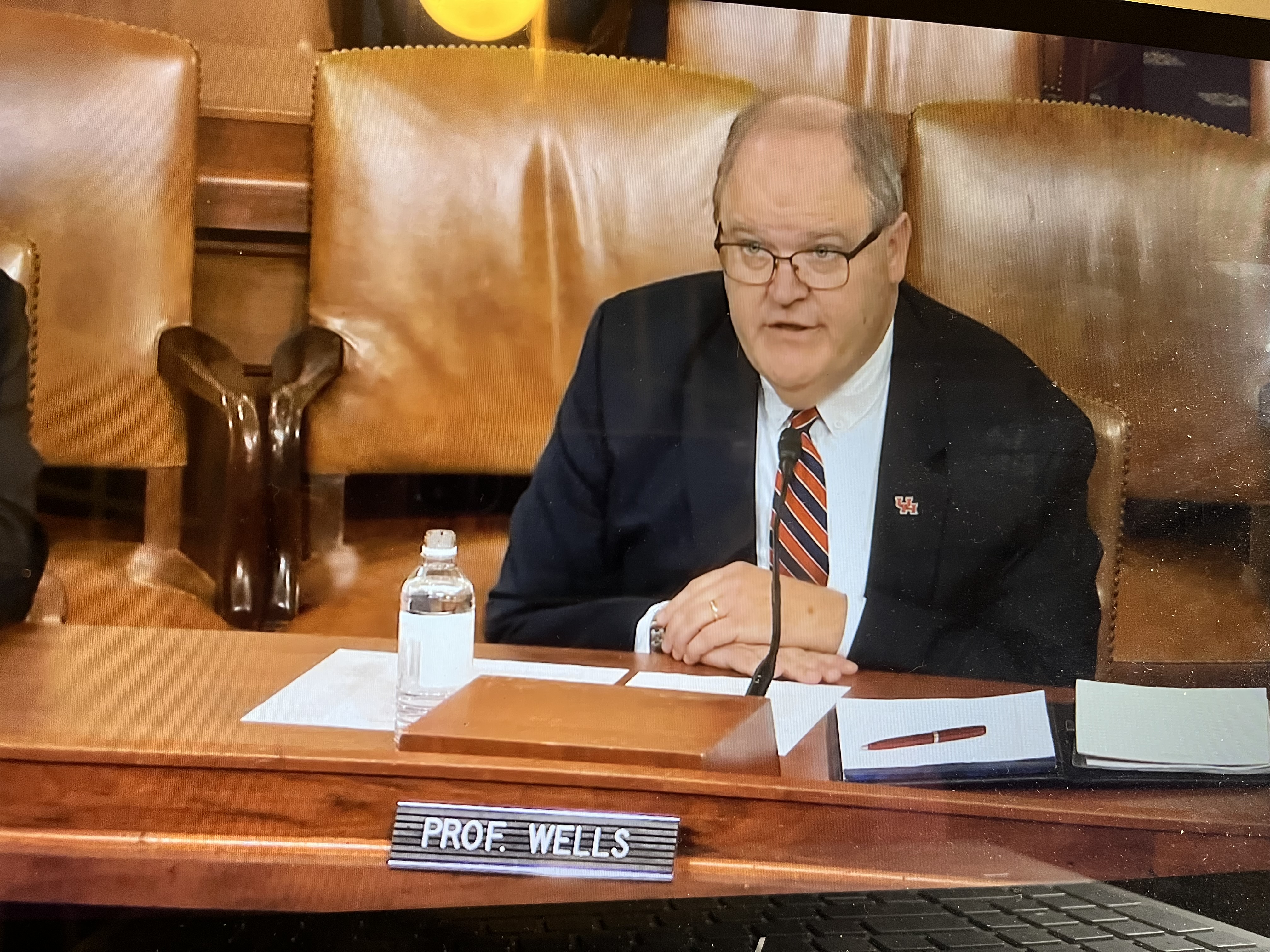

Dec. 3, 2025 ‒ Reforming U.S. international tax laws was the focus of the testimony presented today by Bret Wells, John Mixon Chair and Professor of Law at the University of Houston Law Center, before the House Ways and Means Committee, the nation’s oldest and influential tax-writing body.

“In order to preserve competitive neutrality and raise much needed revenue, Congress must ensure that business profits earned within the United States are subjected to a comparable amount of taxation regardless of whether the U.S.-situs business is owned by a U.S. person or a foreign person,” he said at the hearing.

Wells, an expert on tax policy and director of UHLC’s Tax Law Program, noted that although Congress in 2017 and 2025 approved reforms dealing with U.S.-owned and foreign-owned companies that do business internationally, more action is needed to close loopholes.

His testimony covered two key areas:

Addressing the latter would end incentives for U.S. companies to offshore operations in order to gain a tax advantage, he said.

Wells proposed five reform measures that should be made to prevent profit shifting strategies that seek to move profits out of US-situs companies and into affiliated foreign companies located in offshore jurisdictions with low taxation.

His suggestions for outbound taxation are aimed at ensuring that U.S. companies don’t engage in inappropriate profit shifting through the use of foreign subsidiaries as the means to sell goods or provide services to U.S. customers. U.S. shareholders are subjected to U.S. taxation on earnings derived in their foreign subsidiaries but at a lower rate than what is levied on profits earned through domestic companies conducting business within the United States. This disparity puts American-based companies at a disadvantage, Wells said.

“It should not be the case that a U.S. multinational can achieve lower tax rates on the sale of goods or the provision of services to U.S. customers via offshore affiliates than would be possible if those activities were conducted from within the United States with U.S.-situs

companies,” he testified. “Granting a controlled foreign corporation a lower tax rate for the sale of goods or the provision of services to U.S. customers promotes offshoring of U.S. business activities.”

Wells made two recommendations to close this particular loophole and six additional recommendations on how U.S. outbound taxation could be further simplified.

Wells concluded his remarks by commending committee members for work previously done to improve the international tax system. “Even so,” he said, “more can and should be done.” Professor Wells complete testimony statement is available here: Wells_Witness-Statement-December-3-2025-written-statement.pdf